Tachyon news

Blog

The Role of QR Codes in Ensuring Invoice Validity

Digitalization is the next ruler. Every standard procedure now needs a modern way. This article will discuss the multiple dimensions for which QR codes can be used. The article discusses the role of QR codes in ensuring invoice validation. Moreover, it will discuss how QR codes promise security and transparency.

What exactly is a QR code, and how can it be used?

QR code stands for quick response code. It is a two-dimensional barcode. The barcode contains knowledge that can be scanned through a mobile scanner or cellphone. There are multiple uses of codes in the advanced world. This code is made to take the burden of manual work on itself. It can work more smoothly and quietly than humans. The world is ready to adopt this change. There are many sectors where they are using QR codes. For instance, businesses use QR codes to provide discounts. Many countries are using these everywhere. When it comes to uses, QR codes are being used everywhere. However, the most specific use of QR codes worldwide is in payment methods. It is one of the best and safest methods to deal with payments.

Moreover, there are also other uses, such as QR for educational purposes or detail sharing. Saudi Arabia is one country that uses QR codes as attendance checkers, where all the students have to scan those to present themselves on the attendance list.

How can QR codes and invoice validation work together?

Humans are made to make mistakes. However, tax matters must be made aware of errors. Using QR codes to deal with invoice validations is a good idea. The world is already on its way to adopting this change. It is the best option for invoice validation as it will safely contain the pivotal and correct knowledge of things. These used for invoice validation can be helpful for the government. It will make it easy for the government to track and check the transactions. It will also reduce the chance of inaccurate tax collection. Moreover, for businesses, they help keep records of transactions as well.

Electronic Invoices

The QR code in the e-invoicing system makes it easy to get info about an invoice quickly. You don’t have to search online for it. This helps:

- Speed up business transactions by letting machines read and accurately enter invoice data.

- Tax officers can use handheld devices to check if an invoice is valid and has all the needed info, especially when not in the office.

- Once the Invoice Registration Portal gives back the e-invoice to the supplier with a QR code, the supplier only needs to use the QR code to make a PDF of the signed e-invoice.

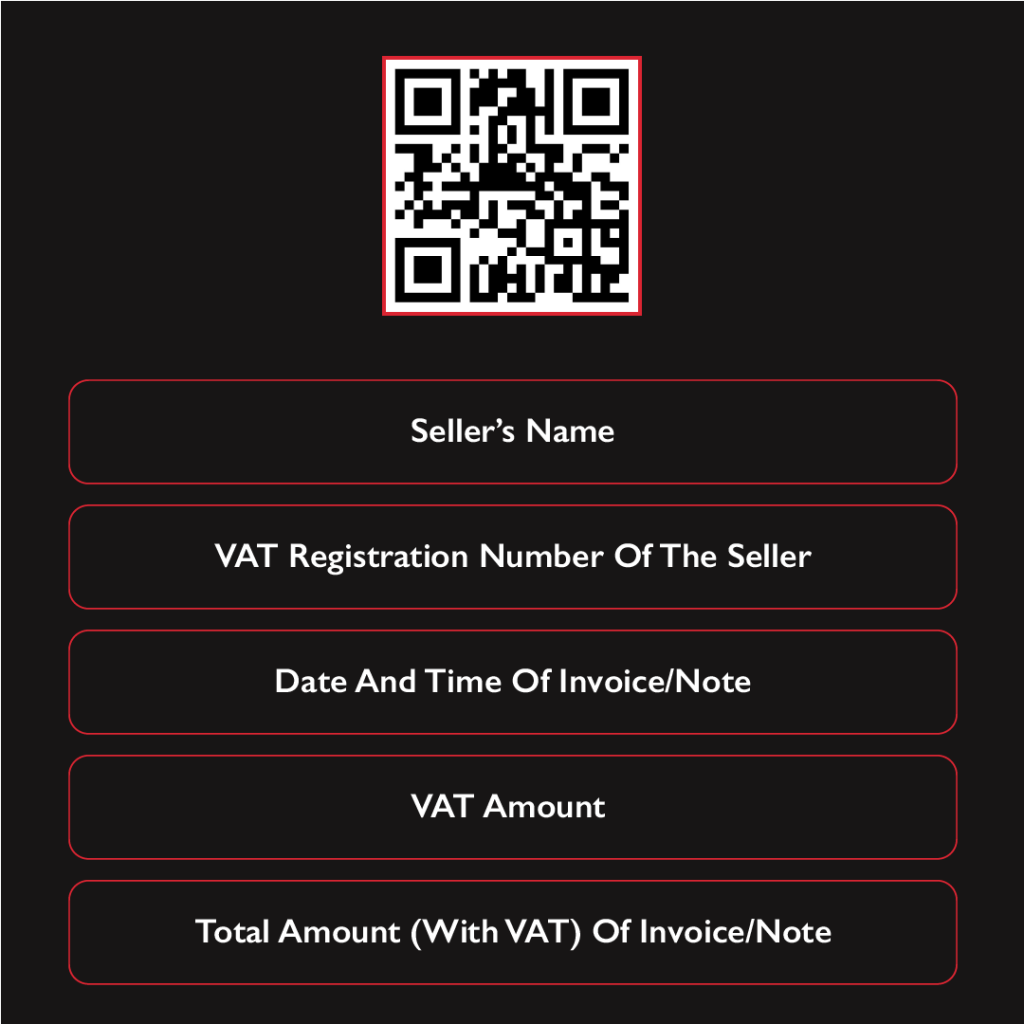

Information managed within the QR code

The QR Code has the following parameters:

- GSTIN of the supplier

- GSTIN of the recipient

- The invoice number is given by the supplier

- Date of the generation of invoice

- Invoice value

- Number of line items

- HSN Code of the main item

- Unique Invoice Reference Number/Hash

How do QR codes promise security?

A QR code is a secure platform to store essential knowledge and data. However, it does not mean there are no risks to using a code. There are also some ways in which scammers have hacked codes. A malevolent QR code can also access sensitive data like credit card details. It is always recommended to be careful. It is hard to identify fake codes.

Benefits of adopting a QR code

There are many benefits to a QR code. In the below paragraph, we mention some of the benefits of QR codes. The first advantage is that it increases the efficiency and productivity of businesses. It demands less space for more knowledge. They also offer fast-track transactions. It is trackable. They help companies to keep records of their transactions. For the government, it helps to impose accurate taxes without any error.

How has Saudi Arabia adopted the QR code for tax invoicing?

Saudi Arabia has realized the potential of QR codes. The country is moving towards invoicing the tax procedures of the General Authority for Zakat and Tax. This change will ensure a transparent, fair, and fast tax procedure. It is a transformation from paper invoicing to electronic invoicing. This transformation will also help make VAT easier, which will help identify the wrong activities. The country has introduced a mobile application for verifying invoices. The user has to download the VAT application. After downloading, the user must scan the QR code on the home page. After scanning it, the user will get the details.

What is the future of QR codes for invoice validity?

Indeed, QR codes are the future of invoice validity. The above paragraphs show how it is beneficial. Adopting the code for invoice validity is the future. Saudi Arabia is also living in the future. They both have embraced the change, which will benefit them. However, it is still being determined that the world will accept this change as it will improve their transparency and efficiency. Also, this change will reduce the fraudulent acts in the tax department. It will help in gaining benefits for both governments and businesses.

To sum up, a QR code is a secure method for invoicing. People love to digitise their lives. People are promoting codes as a better option for invoicing. It provides them with security, transparency, productivity, and quickness. Adopting it for business invoicing is more than a wise decision. This decision helps the owners feel efficient and benefit.

Frequently Asked Questions

What is the purpose of the QR code on the invoice?

QR code on invoices simplifies payments, improving efficiency. Scan to access payment details and complete transactions.

How does QR code validation work?

The validation ensures authenticity. Scanning verifies information, preventing fraud and providing secure transactions.

What is the purpose of a QR code on a document?

A QR code on a document helps to access data quickly. Scan for instant retrieval of information, improving user convenience.

What is the purpose or benefits of a business using a QR code?

Business QR codes increase engagement. They offer quick access to information, promotions, or transactions, enhancing customer interaction and satisfaction.